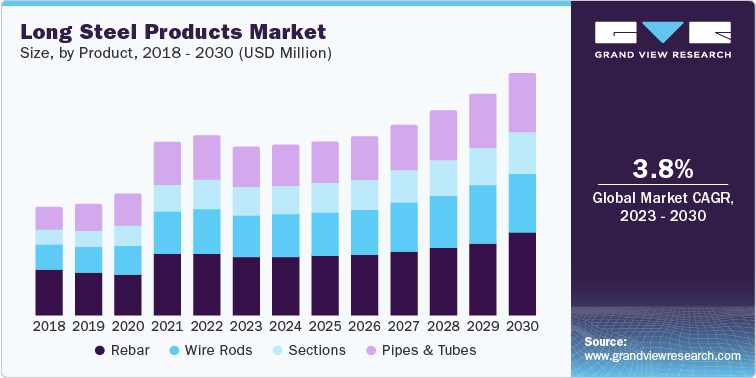

Global long steel products sector database is a collection of market sizing information & forecasts, trade data, pricing intelligence, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, such information is systematically analyzed and provided in the form of outlook reports (1 detailed sectoral outlook report) and summary presentations on individual areas of research along with an agricultural statistics e-book.

Steel is a vital industry for global economic growth and long steel products play a crucial role in the development of infrastructure across the globe. It is a key raw material used in producing long products for building & construction and various manufacturing activities. As per the World Steel Association, the total value contribution by the steel industry is USD 2.9 trillion, which is equivalent to 3.8% of global GDP.

Steel Rebar Market Growth & Trends

The global steel rebar market size was valued USD 258.44 billion in 2022, according to a new report by Grand View Research, Inc., expanding at a CAGR of 2.9% from 2023 to 2030. The construction segment dominated the steel rebar market, with applications such as construction, infrastructure, and industrial purposes. Asia Pacific accounted for more than half of global steel rebar demand, owing to the easy availability of raw materials and investments in construction activities.

China ranked among the top producers and consumers of steel rebar globally. India follows suit after China, as the second largest consumer of steel rebar. The demand in these countries is primarily driven by investments in construction and infrastructure through government-aided policies to boost development in the region.

Wire Rod Market Growth & Trends

The global wire rod market size was valued USD 186.00 billion in 2022, according to a new report by Grand View Research, Inc. The market is expected to expand at a CAGR of 4.6% from 2023 to 2030. Wire rods are manufactured by drawing hot metals through shafts to develop wires with reduced diameters. Wire rods represent the most ductile form of long steel products owing to their high ductility and easy availability in different diameters. They are widely used in construction and fencing applications.

Increasing investments in infrastructure development projects and flourishing construction and automotive industries worldwide fuel the global consumption of wire rods. The demand for wire rods is closely linked to the construction sector, which tends to be cyclical and can be affected by factors such as interest rates, government policies, and economic growth.

Growing infrastructure investments in the North American region are anticipated to benefit the growth of the market. For instance, under the Infrastructure Development Act passed by the U.S. government, the authorities are estimating that California is likely to receive USD 14.00 billion for rebuilding infrastructures, including water supply, bridges, roads, and communication. Similar investments were announced for other states in the U.S.

Steel Sections Market Growth & Trends

The global steel sections market size was valued USD 123.10 billion in 2022, registering a CAGR of 4.5%, according to a new report by Grand View Research, Inc. Steel sections are commonly used in the construction industry, they also have a significant role in the automotive industry. The demand for steel sections in the automotive industry is growing due to several factors, including safety requirements, lightweight, cost-effectiveness, design flexibility, durability, and corrosion resistance. The non-residential construction segment held the largest revenue share of over 54.0% of the global market in 2022. Growth in the non-residential construction industry, driven by urbanization, infrastructure development, and economic growth, has increased the demand for steel sections.

Asia Pacific dominated the global steel section market and is expected to continue over the forecast period. The stronghold of the region is attributable to the presence of raw material suppliers, manufacturers, and end-users. Asia-based manufacturers are expanding their production to cater not just to domestic customers but to international demand as well.

Order your copy of Free Sample of “Long Steel Products Industry Data Book - Steel Rebar, Carbon Steel Pipe Fittings, Steel Pipes & Tubes and Steel Wire Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Steel Pipes and Tubes Market Growth & Trends

The global steel pipes and tubes market size was valued USD 185.47 billion in 2022, according to a new report by Grand View Research, Inc. It is expected to expand at a compound annual growth rate (CAGR) of 3.7% from 2023 to 2030. Increasing oil & gas production owing to the demand from the transportation industry is one of the prominent growth drivers for the market. The oil & gas industry is the major consumer segment for steel pipes & tubes.

Asia Pacific emerged as the leading regional market in 2022 and accounted for a revenue share of over 64.7%, owing to the rising product consumption in the region. China, Japan, South Korea, Southeast Asia, and India are the major product consumers in the region owing to the presence of huge manufacturing, petroleum, and petrochemical sectors.

The Middle East & Africa are expected to register a growth rate of 1.8% in revenue in the said forecast period. Rising investment in the new oil & gas project is expected to propel the demand for pipes & tubes in the forecast period. Egypt has set its sights on increasing its oil production by 11% in 2023, aiming to reach a daily output of 650,000 barrels compared to the current 587,000 barrels daily. This expansion plan aligns with the commencement of operations in new oil fields and the expansion of existing fields in the Suez Canal region.

Competitive Landscape

Key players operating in the Long Steel Products Industry are –

• ArcelorMittal

• AWAJI MATERIA CO., LTD.

• Baosteel

• Bassi Luigi & C.S.p.A

• Bekaert

• Delcorte

• Erne Fittinga GmbH

• Evraz Plc

• Gerdau S.A.

• Henan Hengxing Science & technology Co., Ltd

• Hyundai Steel

• JFE Steel Corporation

• Jindal Steel & Power Ltd. (JSPL)

• JSW Steel Limited

• Kobe Steel Limited

• Nippon Steel Corporation

• NLMK

• Nucor

• PARKER HANNFIN CORPORATION

• Rama Steel Tubes Ltd.

• S.S.E. Pipefittings Limited

• Steel Authority of India Ltd. (SAIL)

• Tata Steel Group

• Tianjin Huayuan Metal Wire Products Co.Ltd.

• United States Steel

• Wuhan Iron & Steel Corporation

Comments

Post a Comment